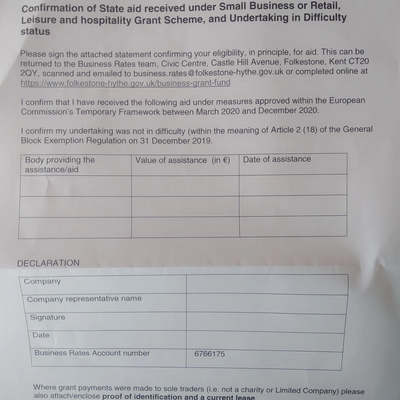

Folkestone and Hythe: Company Declaration of State Aid Form

All businesses that have had grant aid support via Folkestone and Hythe District Council in the form of the Small Business Grant (£10,000) or Retail, Leisure and Hospitality Grant (£10,000 - £25,000) have now received a form to complete to confirm they were eligible for the grant and that they can keepi it.

It's not the clearest form in the world, but it is essential this form is competed and returned, as otherwise the full value of the grant may be required to be returned. We don't want that. No-one wants that.

Being in business myself, I got a form for my company, and also had a number of local businesses raise with me the form and how to complete it. I've spoken to the F&H Business Support department and they have helpfully (thanks Jo!) both added some examples of how to complete the form to the Council website and given me the guidance I needed to complete my form. I've then written my notes up below in case they help others!

There is now a section on the Folkestone and Hythe District Council website "Declaration of receipt of state aid" https://www.folkestone-hythe.gov.uk/business-grant-fund that both gives an example of how to fuill the form in, and also allows you to complete it online at https://www.folkestone-hythe.gov.uk/forms/confirmation_state_aid .

Almost all businesses are going to have only one or two lines to complete on the form. They are likely to look something like:

| Body providing the assistance / aid | Value of assistance (3) | Date of assistance |

| Folkestone and Hythe District Council Small Business Grant (1) | £10,000 (or €11,028) | 6/4/2020 (or the day it was paid to your bank account) |

| HMRC Employment Allowance (2) | £4,000 (or €4,411) | 24/4/2020 |

(1) Some businesses will have got a "Folkestone and Hythe District Council Retail, Hospitality and Leisure Grant" instead with the value of £10,000-£25,000 (or €11,028 - €27,578). If you did, use that instead.

(2) This was granted in the budget to businesses that employ staff - it effectively pays the first £4,000 in the 2020/21 tax year of Employer NI on staff you employ (its been £3,000 in recent years). Your business is likely to have had a letter confirming this, and saying that it should be declared where required as state aid. As the maximum value in 2020 is £4,000, and the letter I got for my business was dated 24/4/2020, I've completed it on that basis.

(3) The form says to complete in Euros (and the online form requires it). If you are filling it in in £ that's fine, just be clear you have done so. The € figures I give above are conversions based on todays exchange rate (23/6/2020).

Then you complete the bottom section (Company, representative name, signature, date, business rates account number (called "Demand for account no" on your 2020 Non Domestic Rates Notice). By completing that you are comfirming the following TWO things (legally):

I confirm that I have received the following aid under measures approved within the European Commission's Temporary Framework between March 2020 and December 2020.

You are confirming you've reveived less than €800,000 in "state aid" in the last year. Probably a reasonably simple declaration for almost all of us - we're not going to be even close!

I confirm my undertaking was not in difficulty (within the meaning of Article 2 (18) of the General Block Exemption Regulation on 31 December 2019.

Essentially, your business was not bankrupt, in liquiation, held by the reciever or in the process of becoming any of thise things. This is more technical, but if you think there was any risk of your business being defined that way, the rules in full are at https://ec.europa.eu/competition/state_aid/legislation/gber_regulation_en.pdf

The key confirmation is:

"Where the undertaking is subject to collective insolvency proceedings or fulfils the criteria under its domestic law for being placed in collective insolvency proceedings at the request of its creditors."

If you are fine with both of the above, you are fine to finish. Finish the form (on paper or online), send it back or submit, and job done.

If you have ANY questions about the completion of the form, or your eligibility for the grants you've had now you've seen these things, don't panic: call the Folkestone and Hythe business rates team on 01303 853223 in office hours to talk it through.