Small Business Rate Relief in Folkestone & Hythe District: Now is the Time to Claim

The Government announced earlier in March that all businesses that received full Small Business Rate Relief would qualify for a £10,000 grant (non-repayable). There is now more news on this scheme, and for Folkestone and Hythe businesses a form to complete to claim the payment.

Please note that I will link ONLY to the Folkestone and Hythe District Council website here for security to reassure you I'm not operating a scam.

Firstly - what businesses are covered by this scheme? It includes all businesses that occupy a property which is subject to business rates, and that they get 100% Small Business Rate Relief. That applies to all properties with a rates valuation under £15,000 - essentially almost all business properties in Sandgate, and many smaller ones in Folkestone and Hythe. Exceptions are:

- Properties with a rateable value over £15,000;

- Property should be occupied for Business use only;

- Properties occupied for personal use are excluded i.e. beach huts, private stables, moorings;

- Car parks and parking spaces do not qualify;

- Businesses that were in liquidation or dissolved as at 11 March 2020 will not be eligible.

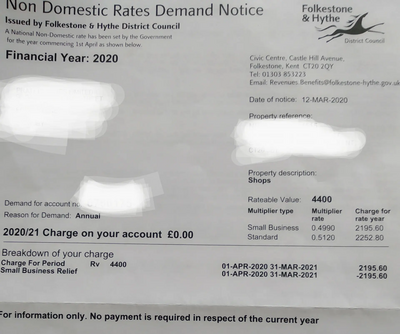

You should have received in March a Non Domestic Rates Demand Notice in the name of your business showing the "Charge for Period" and a corresponding "Small Business Relief" line for the same amount. If you have that, you are eligible.

Secondly: What do you mean by a £10,000 grant? I mean £10,000 paid into your business bank account as a grant - NOT a loan, no requirement to pay it back, no further terms and conditions. It will be taxable as business income (so if your business then makes £10,000 profit in year, you'll pay tax on that) but that's it. It's genuinely £10,000 for your business to help you through these times.

Thirdly: OMG: How do I claim?

You need to make a claim only essentially because the Council does not have your business bank account details to pay your grant into. You need to provide that information for your business so that they can do so: hopefully before the end of April. Round up your Non Domestic Rates Demand Notice from March, your Business registration number (if applicable), your VAT number (if applicable) and your business bank account details, and go to the Folkestone and Hythe District Council website at https://www.folkestone-hythe.gov.uk/business-grant-fund

Follow the button to "Apply to Business Grant Fund", and then complete the form having selected "Small Business Rate Relief Recipient". The sooner you do so, the sooner the Council will be able to make payment to your business (hpefully before the end of April, but without your details - no payment will be possible).

Note - there is a similar scheme that may apply if your business qualifies: the Retail, Hospitality and Leisure Grant (RHLG). For that businesses would have been in receipt of the Expanded Retail Discount (which covers retail, hospitality and leisure) on 11 March with a rateable value of less than £51,000 (RV's under £15k: £10k Grant, RVs £15k-£51k: £25k grant). Learn more at https://www.folkestone-hythe.gov.uk/article/1103/Emergency-measures-for-business

Sign up

for email updates